Central Depository Securities Ltd (CDSL) – Fundamental and Technical View

Company Overview:

Central Depository Services Limited (CDSL) is a leading Indian central securities depository, based in Mumbai. It was established in 1999 and is promoted by the Bombay Stock Exchange (BSE), along with other leading banks and institutions. First Publicly Listed Depository in India: CDSL was the first depository in India to go public, which enhanced its transparency and credibility. This move has increased investor confidence and broadened its shareholder base. Strong Market Position: As one of the only two depositories in India, alongside NSDL, CDSL enjoys a significant market share. This duopoly minimizes competition and allows for a stable operational environment.

- Founder: BSE Ltd

- Founded In: 1999

- Market Cap: Large Cap with Mkt Cap Rs. 24520(Cr.)

- Webside: www.cdslindia.com

- Sector: Finance – Investments

Fundamental Analysis:

- The company has shown significant profit growth of 31.42% over the past three years, driven by its efficient operations and stable revenue streams .

- CDSL’s revenue growth has been impressive, with a 3-year CAGR of 33.3%.

- The company’s return on equity (ROE) has been healthy, with a 3-year average of 32.86%.

- CDSL’s debt-to-equity ratio is 0, indicating a virtually debt-free balance sheet.

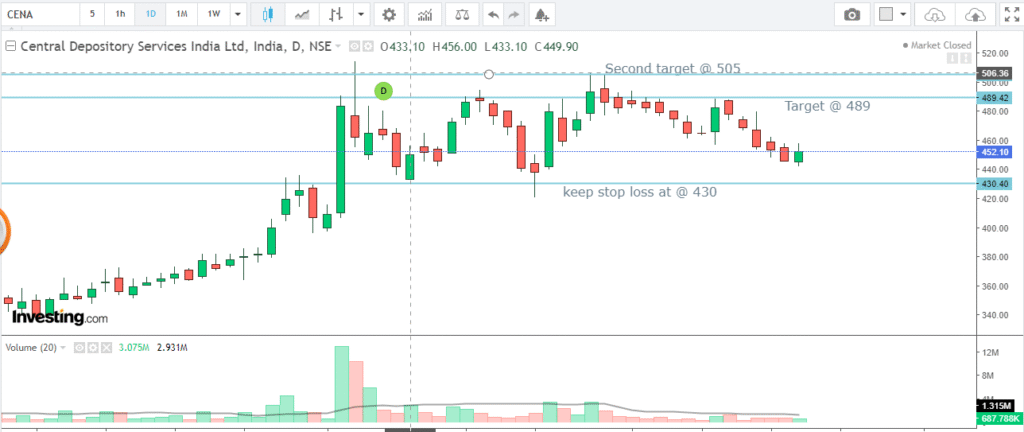

Technical Analysis:

A positive trend reversal has been found on the chart with good volume. As per price action morning star candlestick pattern is identified at the bottom of the chart. The buying price is ₹ 1129, and the stop-loss is at the rate of ₹1073 on a closing basis. The first target would be ₹1309 and the second target would be ₹ 1470, This chart expects positive movement for the medium-term and long-term. As per Gap Theory, it can go up to fill the precious Gap which is at the price ₹ 1470.

Disclaimer: Only for educational purposes no recommendation, before taking the entry please take advice of your financial advisor.