sagility ltd – Fundamental and Technical View

Company Overview:

Sagility is a global BPM (Business Process Management) company, formerly part of Hinduja Global Solutions (HGS), focusing on healthcare outsourcing and digital transformation services.

Sagility serves Payers (health-insurance companies) and Providers (hospitals, physicians, diagnostics, medical devices) primarily in the U.S. market. Its service offerings span the healthcare value chain, For Payers: enrolment/benefits administration, member engagement, clinical & case management, analytics, payment integrity, claims cost-containment. For Providers: revenue cycle management (billing, coding, AR follow-up), patient access & engagement, lab/medical-device support. Technology and analytics are emphasized: the company uses platforms, document-processing engines, GenAI for customer & member engagement, and automation of revenue cycle operations. The value proposition: A healthcare-specialist BPM services provider (rather than broad IT/BPO), providing domain expertise + cost-effective offshore/onshore model.

Founder: Ramesh Gopalan

Founded In: 2021

Market Cap: Large Cap with Mkt Cap Rs. 24520(Cr.)

Website: www.sagilityheal.com

Sector: Health Care- Insurance

Fundamental Analysis:

Focused on the high-growth US healthcare BPO segment, where demand for outsourcing is increasing.

Consistent revenue growth post-demerger from HGS.

Strong cash flow generation and low debt.

- Promoters are holding 67.40% share, which indicates strong promoter confidence.

Technical View:

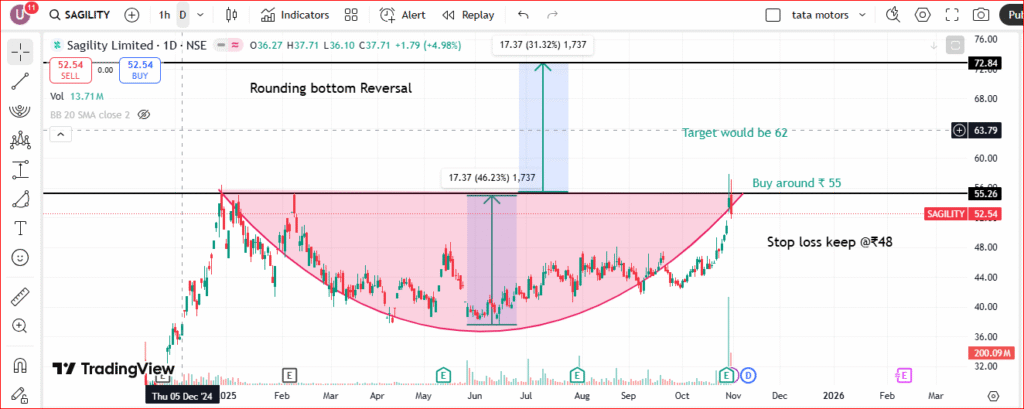

Pattern: Rounding Bottom Reversal

The stock has formed a Rounding Bottom pattern, which signals a long-term trend reversal from bearish to bullish.

Neckline (Resistance): ₹55.26 — this is the key breakout level.

Current Price: ₹52.54 (below the neckline), so breakout not yet confirmed.

Support Zone: ₹45–48.

Buy Zone: Around ₹55 (on confirmed breakout with good volume).

Target 1: ₹62

Target 2 (Full pattern target): ₹72–73

Stop Loss: ₹48 (below recent swing low).

Volume Action

There was a sharp rise in volume during the recent upward move — a bullish sign.

However, for a confirmed breakout, it must close above ₹55 with strong volume for 2 consecutive sessions.

Momentum Indicators (Based on visual cues)

RSI likely approaching overbought zone (~70), so some short-term consolidation is possible.

The rounding bottom suggests medium-term bullishness if the neckline breakout sustains.

Disclaimer: Only for educational purposes no recommendation, before taking the entry please take advice of your financial advisor.